Here's a breakdown of new refund scams the IRS wants you to be aware of.

SOURCES:

PROCESS:

It's National tax Day, and you're probably imagining how you'll spend that fat refund, but hold tight--the IRS is warning everyone to be on the lookout for fraudulent phishing emails and calls by Con Men claiming you're refund's ready.

So our Verify team is showing how it works and how to avoid being duped

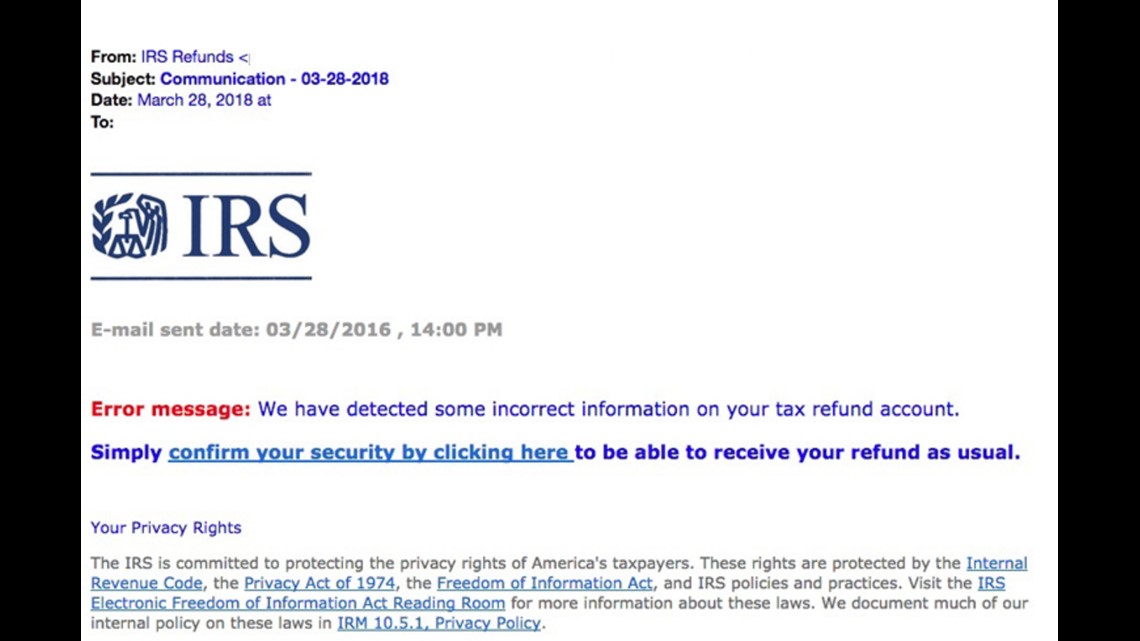

Popular Scam #1: Phishing Email

Experts say phishing emails are tricksters' preferred tactic because it's cheap, easy and generally, untraceable.

Like most scams, this ones after your personal info. The email prompts you to click a hyperlink to see or access your tax refund.

The email typically bears the agency logo, and has a hyperlink that redirects you to a fake page. The hyperlink can also download malware onto your device.

Remember IRS WON'T randomly email you--they prefer snail mail.

Popular Scam #2: Debt Collector Phone Call

Someone calls posing as a debt collecting agency on behalf of the IRS explaining you got an erroneous refund and they try swindling you to forward money to their collection agency.

The Better Business Bureau says legit private debt collectors will not ask and can't accept, credit card information over the phone.

Popular Scam #3: CPA Locked Out of IRS Portal

Thieves are targeting CPA's too. The IRS says they've seen cases where accountants are sent bogus emails warning that they've been locked out of their IRS e-services portal and need to update their information.

You can report sketchy emails to phishing@irs.gov.

If you have an erroneous refund that you want to return, the IRS says:

If your refund was a paper Treasury check and hasn't been cashed:

- Write "Void" in the endorsement section on the back of the check.

- Submit the check immediately, but no later than 21 days, to the appropriate IRS location listed below. The location is based on the city (possibly abbreviated) on the bottom text line in front of the words TAX REFUND on your refund check.

- Don't staple, bend, or paper clip the check.

- Include a note stating "Return of erroneous refund check because (and give a brief explanation of the reason for returning the refund check)."

If your refund was a paper Treasury check and has been cashed:

- Submit a personal check, money order, etc., immediately, but no later than 21 days, to the appropriate IRS location listed below. The location is based on the city (possibly abbreviated) on the bottom text line in front of the words TAX REFUND on your refund check. If you no longer have access to a copy of the check, call the IRS toll-free at 800-829-1040 (individual) or 800-829-4933 (business) (see telephone and local assistance for hours of operation) and explain to the assistor that you need information to repay a cashed refund check.

- Write on the check/money order: Payment of Erroneous Refund, the tax period for which the refund was issued, and your taxpayer identification number (social security number, employer identification number, or individual taxpayer identification number).

- Include a brief explanation of the reason for returning the refund.

- Repaying an erroneous refund in this manner may result in interest due the IRS.

If your refund was a direct deposit:

- Contact the Automated Clearing House (ACH) department of the bank/financial institution where the direct deposit was received and have them return the refund to the IRS.

- Call the IRS toll-free at 800-829-1040 (individual) or 800-829-4933 (business) to explain why the direct deposit is being returned.

- Interest may accrue on the erroneous refund.

For more information on tactics scammers are using to solicit your digits, visit this IRS Alerts page.