WASHINGTON — D.C. has scored a major victory against a blighted property that has been at the center of WUSA9 reporting dating back to 2020.

Monday, D.C. Attorney General Brian Schwalb a $1.8 million judgment against the owners of 1000 C St. NE for evading the District’s tax on vacant properties. OAG sued the property’s owner, George Papageorge and his entity, 10th & C Streets Associates, LLC, alleging that for more than a decade, they had falsely claimed the property was occupied, when it was not, to avoid paying required taxes.

Now, Papageorge and 10th & C Streets Associates must pay the outstanding property taxes, as well as significant damages, civil penalties, and interest to the District.

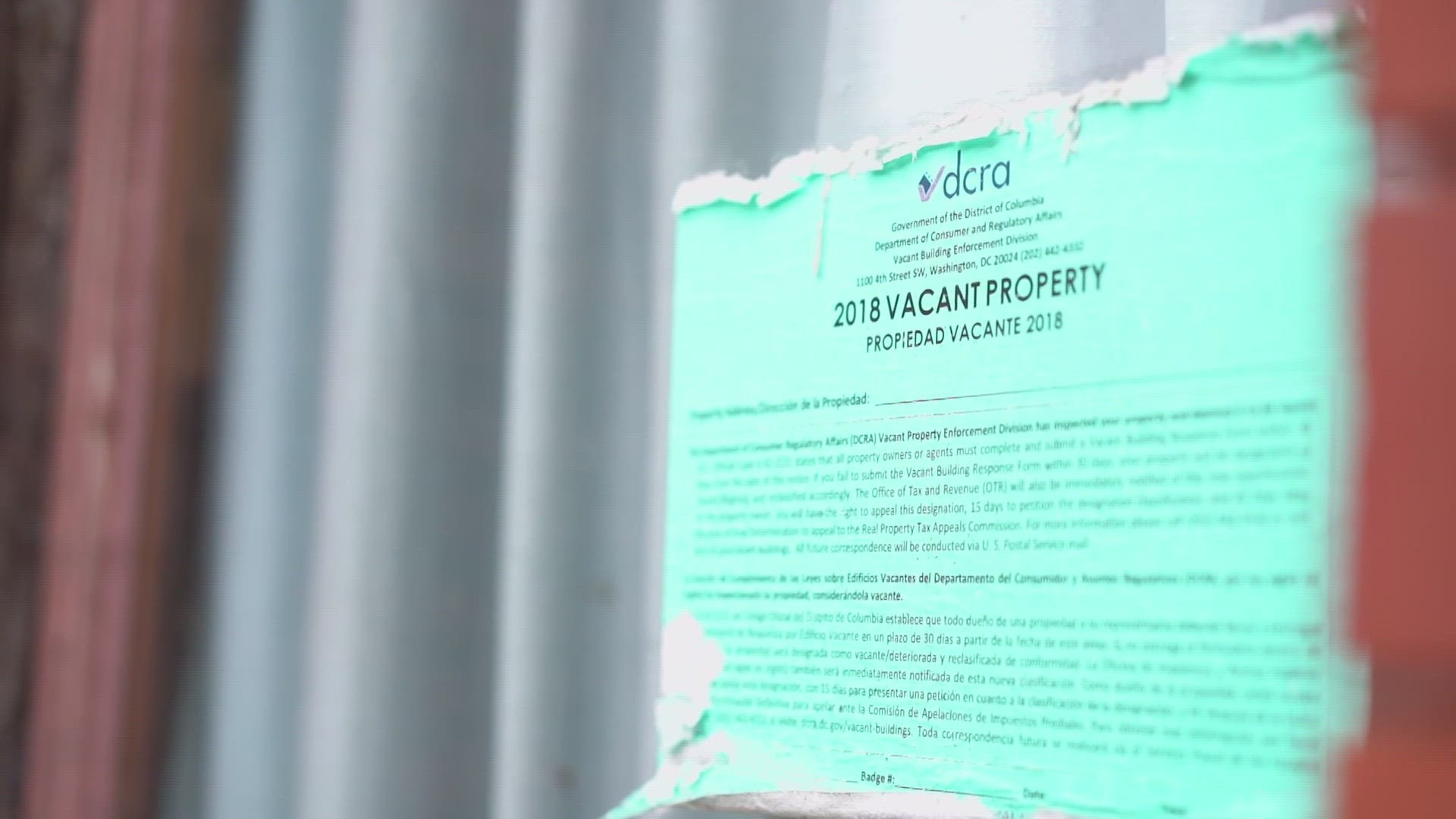

WUSA9 visited 1000 C St. NE in November 2020 for research on the city's handling of blighted properties. WUSA9 found vacant property stickers, plywood doors and weeds growing from the roof of the property.

"It's really just a sad vision for this area, and I don't know what else we can do." neighbor Sharon Boeson told WUSA9 in 2020. "I've talked to council members; I've talked to DCRA. I've spoken with vacant property offices. I've spoken with other people who know of other buildings around the city. Nobody does anything."

There's even a parody Twitter account dedicated to 1000 C Street, calling out years of delinquent D.C. property tax bills on the property and lampooning the building as an eyesore.

WUSA9 spoke to Papageorge back in November 2020, and he said he considers D.C.’s treatment of him as “unconstitutional extortion.” Papageorge wrote in a later email that D.C.'s property classification system "is very often imposed with no due process and that property owners' appeal rights are usually stymied (purposefully) and trampled upon by the District of Columbia government."

He declined to say what he would do with the property in the future and did not answer any further questions. WUSA9 was not immediately able to reach Papageorge about Tuesday’s judgement.

“Vacant and blighted properties reduce the District’s already-tight housing supply and threaten neighborhood safety and quality of life,” said Attorney General Schwalb. “Absentee owners, in order to reduce their tax bill, must repair these properties and return them to use. And when they falsely represent the occupancy status to try to evade their taxes, they will be held accountable, not only to pay the taxes and interest, but a much larger bill—one that includes substantial damages and penalties.”

Empty and blighted properties can pose risks to neighborhood health and safety, and they decrease the city’s already limited housing supply. To motivate owners to keep properties in use, the Council imposed significantly higher property tax rates on vacant and blighted homes. Under the D.C. False Claims Act (FCA), it is illegal to knowingly make false statements to conceal, avoid, or decrease an obligation to pay the District. Those who break the law—for example, by attempting to avoid tax obligations by falsely claiming a property is occupied when it is actually vacant—can face steep penalties. Individuals and companies that violate the FCA can be ordered to pay up to three times the amount that they originally owed (treble damages) and face civil penalties.

After the Council, in 2021, expanded OAG’s enforcement authority under the FCA, the office worked with the Office of Tax and Revenue, the Department of Consumer and Regulatory Affairs (now the Department of Buildings), and members of the community to learn about long-term vacant properties where owners were evading taxes. In its lawsuit against Papageorge and his company, OAG describes how their systematic and false reporting to the city that 1000 C St. NE was occupied, even as the once-stately home sat empty and deteriorating. For at least 16 years, Papageorge continuously violated the law by refusing to pay the required tax on vacant homes even as his property sat boarded up, overgrown, with crumbling masonry, a visibly decaying roof, and vacancy notices pasted on top of vacancy notices from previous years.

“This will be great news for the neighborhood, who’s complained about this vacant property fraud on the public for at least a decade,” said DC Council Chairman Phil Mendelson. “Maybe now the property owner will use it in a way that could benefit District residents or contribute to the community’s residential housing market.”

“1000 C St. NE has long frustrated neighbors,” said Ward 6 Councilmember Charles Allen. “Rather than be a contributing home in our community, the owners have actively evaded paying vacant property taxes and lied to the city claiming it was occupied. I’ve worked closely with neighbors to document the status of this building over the years and am thrilled by the great work of Attorney General Schwalb and his team to enforce the laws meant to deter homes from sitting empty. Long vacant properties are a drag on the vibrancy and safety of a neighborhood and can present real and expensive problems for next door neighbors when those vacant properties are allowed to deteriorate. This judgment is a warning to any other landlords who aren’t acting responsibly with an empty home.”

“Neighbors and Commissioners have advocated for action on this vacant property for nearly two decades,” said Amber Gove, Chairperson of Advisory Neighborhood Commission 6A. “With this judgment and associated penalties, the District has sent a message to vacant property owners that city residents want to see proactive development, not distanced and derelict mismanagement of our limited housing stock. Penalizing the egregious behavior of the owner of 1000 C St. NE will also set an example to other scofflaw property owners that the District is serious about enforcing the laws on our books.”

After lengthy and contested litigation, the Superior Court entered judgment in favor of the District, ordering Papageorge to pay the District a total of $1.8 million. This includes taxes owed dating back to 2008, treble damages under the FCA, interest, and civil penalties. The judgment stems from $389,561 in unpaid vacant property taxes accumulated over a fifteen-year period.