WASHINGTON — The coronavirus pandemic may have a negative impact on people planning to retire this year.

Financial experts told WUSA9 changes in the stock market have cost most 401K plans to lose about 25 percent of their values.

"I have a number of clients who were actually contemplating retirement and their timing couldn't be worse,” said David Flinchum, a partner and financial expert at the tax firm Cherry Beckard.

Flinchum said 401K, or employee retirement savings -- plans that rely on stock market investments -- have taken a hit because of the coronavirus pandemic.

"Most of 401K assets are invested in the stock market in equities. If that is the case, our 401K accounts have dropped anywhere from 20 to 25 percent over the last couple of months," he explained.

Flinchum advised if a person can avoid withdrawing from their plans to do so.

"The stock market is down and when we make those withdrawals, we've essentially locked in those loses," Flinchum said. "Any amounts that we withdrawal from our 401K plans, we know those amounts are not going to recover as the stock market recovers."

Flinchum suggested people planning to retire this year should exhaust other assets before tapping into 401K money.

Next, he said if someone is not planning to retire anytime soon, they will see changes in their accounts but things should recover.

"I would say millennials, young persons, even persons of my age, don’t have a lot to worry about. Remain calm, stay invested. My guess is that the market will recover," Flinchum said.

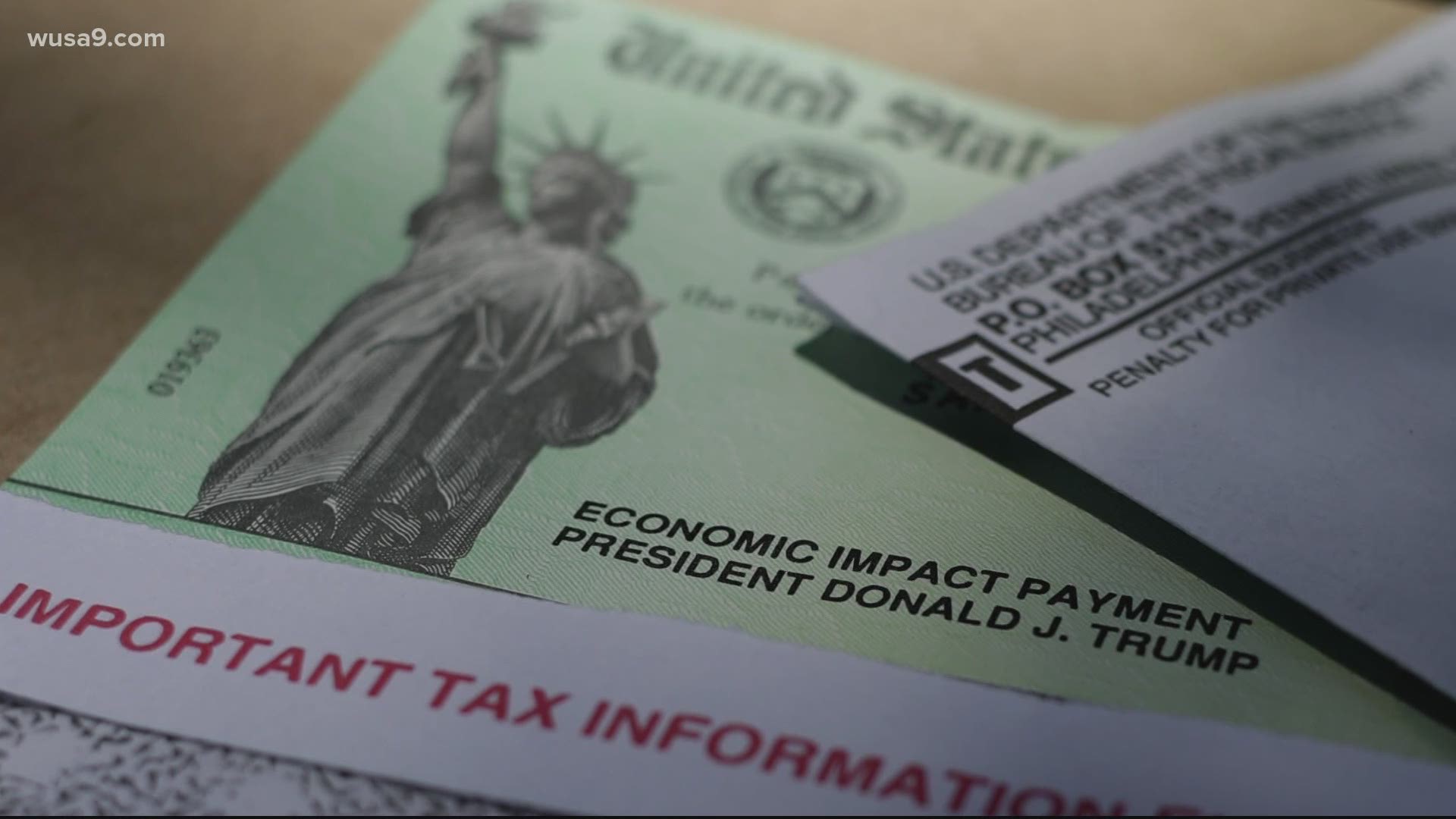

Flinchum added Congress included some protections for 401K plans in the CARES Act.

"The requirement to take a distribution will be suspended this year," he said. "So, the idea of taking a mandatory distribution this year will allow the IRSs and the 401Ks to recover."

If you need cash from your 401K plans because of hardships, loan limits are increased to $100,000 in some cases.

Flinchum explained tax penalties for withdraws are also being waved.

"When we withdrawal from our 401Ks, or and/or IRAs the withdrawals are usually taxable," Flinchum said. "If we're not at least age 59 and ½, the IRS charges an extra 10 percent penalty. This allows a deal, depending on your tax bracket, you might end up with 40 of 50 cents on the dollar."