WASHINGTON — According to the IRS, tens of millions of stimulus check payments have gone out this week, and more are on their way.

If you’re trying to track your payment, you can use the Get My Payment tool. It was launched Tuesday on IRS.gov. According to the IRS, by midday Tuesday people had already used it 6.2 million times.

The tool will tell you whether your payment has been sent, whether it’s been scheduled or if you’re not eligible.

If you’ve filed tax returns in the past without direct deposit, but you want your stimulus check to get in that bank account ASAP, the IRS says you can use that tool to update your info.

We've received a lot of calls and texts from people trying to figure out why they received less than they thought they would. So we spoke to Janet Holtzblatt with the Tax Policy Center as well as the IRS to get answers to your questions.

Question from Ken Suttmeyer:

"I reached out to the Q and A because when I received my stimulus check, which they said was based on adjusted gross income (AGI), I received half of what I should have gotten."

Suttmeyer is referring to the payment structure dictated by the IRS.

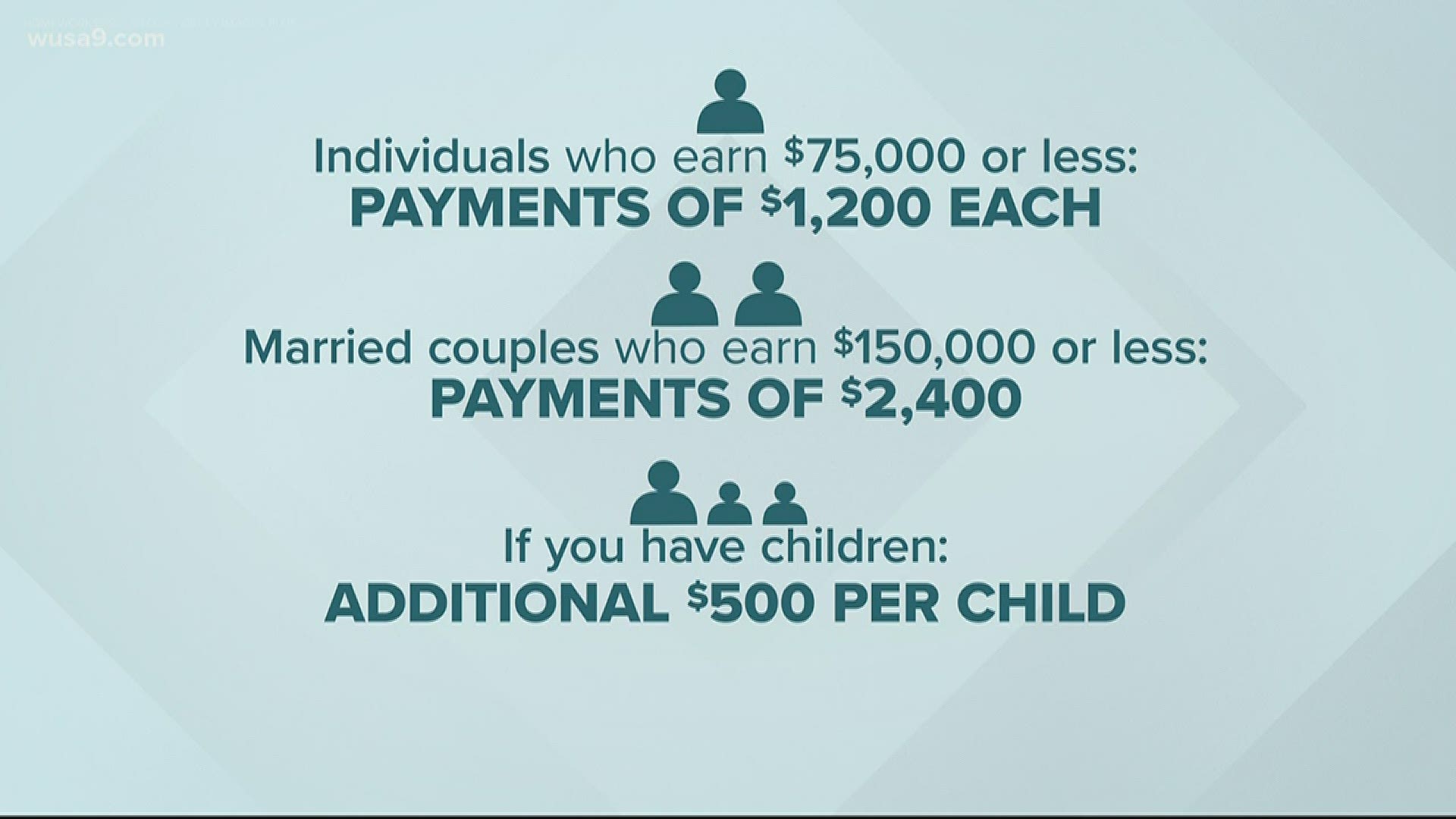

If you file as an individual and the adjusted gross income on your 2018 or 2019 taxes is $75,000 or below, then according to the IRS you should receive $1,200.

Holtzblatt has 3 possible reasons why his stimulus check could have been smaller than he anticipated.

Answer from Janet Holtzblatt with the Tax Policy Center:

"There are several possibilities about what’s happening to Ken."

1. "The first possibility is that he owes child support. In that case, the Treasury Department would be withholding what he owes in child support."

2. "The second possibility is one that I just learned about today, and that is if there is a garnishment against him in the private sector, the bank may be holding what he owes his debtors."

3. "There could also be issues in terms of how the IRS processed his return, and whether they determined that his AGI is different than what he claimed on his return."

Tip:

If you have concerns that the IRS might have withheld some of your money because of back child support or garnishment, then Holtzblatt says you should reach out to your bank. They will be able to confirm that for you.

Question from Sonya H.

"I’m retired, my AGI is $51,000+, so why did mine get dropped to $600?"

Answer from Janet Holtzblatt with the Tax Policy Center and the IRS:

"Same advice as Ken."

We also spoke to the IRS to find out what people should do if they feel they weren’t given the correct amount.

“Everyone who receives a payment will get a notice from us within 15 days indicating some details about the payment," the IRS said in a statement. "In some instances, though not all, there will be an opportunity to make adjustments at that time. We’ll have further details in the days and weeks to come.”

Tip:

The IRS also issued a warning for avoiding scammers.

“The only—and I mean only—official notification you will get will be in an envelope and through the U.S. Postal Service," the IRS said. "With all the information out there about these payments or, for those who haven’t gotten them, payments to come, there are lots of thieves eager to take unfair advantage.”

Our next question comes from Lloyd Freeman in Cumberland, Maryland.

Question 1 from Lloyd Freeman:

"My name is Lloyd Freeman. I reached out to WUSA9 Q&A because everybody says… if you’re on Social Security, or SSI, or both and survivor benefits, you’ll automatically get your check. Well they say they mailed the checks on Saturday direct deposit and I haven’t received anything."

Answer from the IRS:

According to the IRS, stimulus payments for those on SSDI and SSI like Freeman will be automatically deposits in their accounts. The reason he hasn't received anything is because those types of payments haven't been processed yet. The IRS projects those payments "will go out no later than early May."

“Since SSI recipients typically aren’t required to file tax returns, the IRS had to work extensively with these other government agencies to determine a way to quickly and accurately deliver Economic Impact Payments to this group,” said IRS Commissioner Chuck Rettig. “Additional programming work remains, but this step simplifies the process for SSI recipients to quickly and easily receive these $1,200 payments automatically.”

Question 2 from Lloyd Freeman:

"My two daughters get survivor benefits from their mother because their mother passed away in 2014. Will I get extra money for them?"

Answer from the IRS:

Lloyd has two daughters under the age of 17, which qualifies him to receive an extra $500 per child, but unlike the $1,200 that he’ll receive automatically, the IRS says this benefit requires an extra step.

In order to receive those benefits you have to use a special tool available only on IRS.gov and provide the children’s information in the non-filers section.

The IRS says that “if beneficiaries in these groups do not provide their information to the IRS soon, they will have to wait until later to receive their $500 per qualifying child.”

If you have any more questions about stimulus checks, text them to us 202-895-5599.