ANNAPOLIS, Md. — As the American Rescue Plan heads to the Senate, some people who need help are left out of the relief bill again: undocumented immigrants.

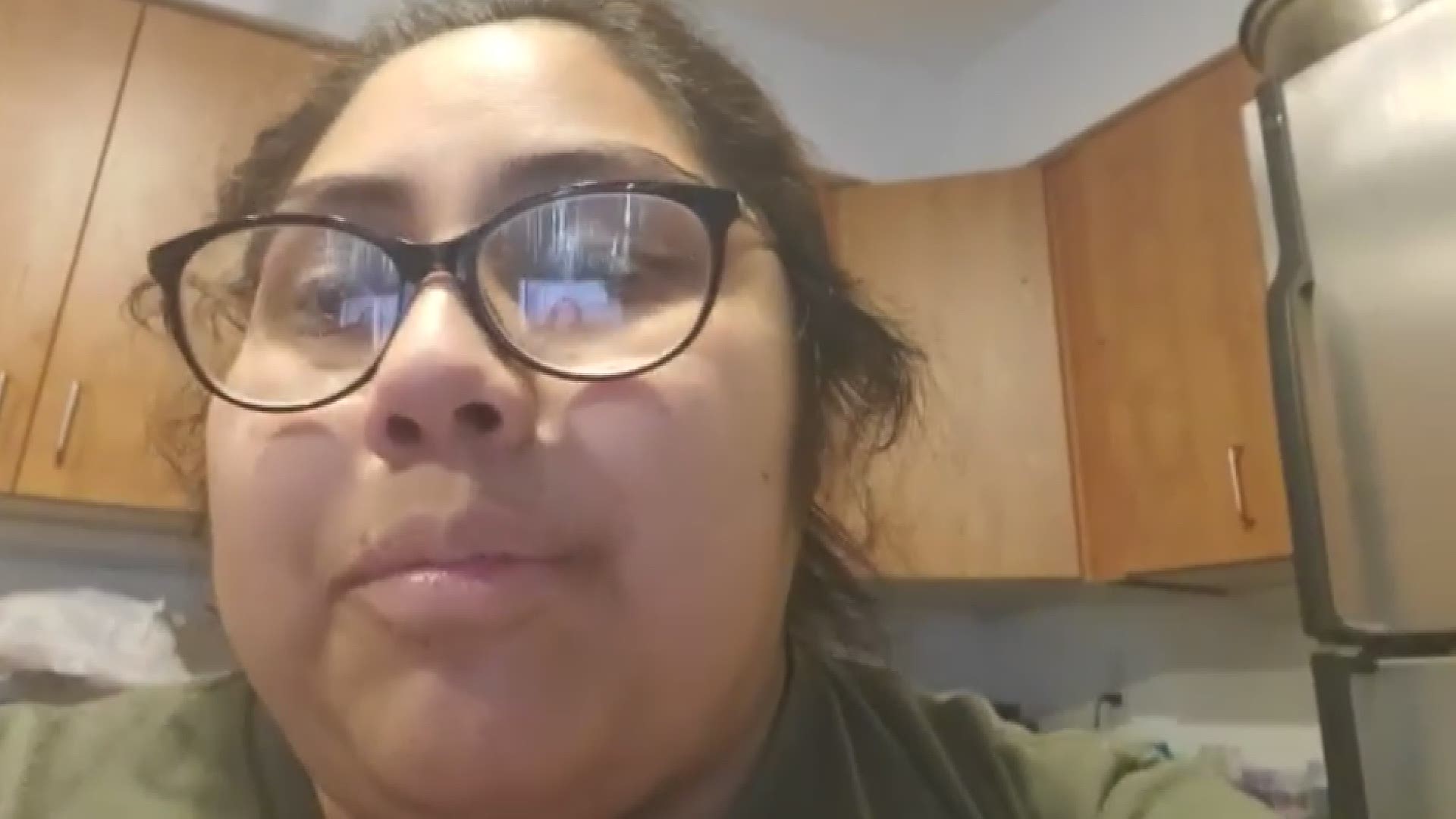

Concepcion Rojas is a recipient of the Deferred Action for Childhood Arrivals policy, or DACA, and currently lives in Annapolis with her three kids -- four years old and younger. She moved to the U.S. from Mexico when she was six.

Rojas said she hasn't received any financial help from the government since COVID-19 hit -- and the pandemic has continued to deal her blows.

First, her husband, also undocumented but not a DACA holder, had to go back to El Salvador in February 2020... while she was pregnant with her third child.

Right before he left, she said they had moved into an apartment that costs upward of $2,000 a month with utilities.

She had been working at a restaurant, but those hours were cut back because of COVID-19, and then her doctor made her stop altogether in April for her and her unborn baby's health.

"I have to keep a roof over my kids, I have to take care of them," Rojas said. "I’m the only one they have right now, and it’s tough."

Last year, Rojas' family filed taxes through her husband's Individual Taxpayer Identification Number (ITIN), because he was the primary breadwinner.

Federal -- and most state -- COVID-19 relief (stimulus checks and unemployment payments) are not available to non-citizens, however, even if they have ITINs.

So, her family couldn't receive any help per the legislation.

"I do feel like they shouldn’t shut people out," Rojas said.

It's left her struggling to pay rent and facing eviction court in March.

CASA has been advocating for its 100,000 members, like Rojas, throughout the pandemic -- trying to get the government to provide them with some financial assistance.

"They are taxpayers…They’re grocery store workers. They’re on the frontlines in hospitals during the pandemic," CASA's chief of federal policy, Alonzo Washington, said. "And it makes just no sense that these legislators are completely ignoring the families that are really in need that are being hurt the most during this pandemic."

The General Assembly in Maryland finally heeded their call -- and passed legislation Friday that would allow ITIN followers to receive earned income tax credit.

A spokesperson for Gov. Larry Hogan said Saturday that the bill will take effect without his signature, since it passed both chambers with a veto-proof majority.

"Legislators were able to sort of make this right by passing this bill yesterday which was an amazing victory for immigrant families," Cathryn Paul, research and policy analyst for CASA, said. "Immigrant families who are the most in need will be able to file for that credit when they file their taxes this year."

Rojas hopes to receive that state credit soon. And, this year, she plans to file taxes on her own in the hopes of also receiving some federal relief. Federal stimulus payments only go to people with Social Security numbers -- which she has through DACA.

"Stressful on me but I try to take it day by day, because I have three little ones that I have to worry about, and I have to be strong for them," she said, getting choked up. "I have to provide for them, and I have to be there for them.”