WASHINGTON D.C., DC — Conservative justices holding the Supreme Court's majority seem likely to sink President Joe Biden's plan to wipe away or reduce student loans held by millions of Americans.

In arguments lasting more than three hours Tuesday, Chief Justice John Roberts led his conservative colleagues in questioning the administration's authority to broadly cancel federal student loans because of the COVID-19 emergency.

The plan has so far been blocked by Republican-appointed judges on lower courts.

It was not clear that any of the six justices appointed by Republican presidents would approve of the debt relief program, although Justices Brett Kavanaugh and Amy Coney Barrett appeared most open to the administration's arguments.

Biden's only hope for being allowed to move forward with his plan appeared to be the slim possibility, based on the arguments, that the court would find that Republican-led states and individuals challenging the plan lacked the legal right to sue.

That would allow the court to dismiss the lawsuits at a threshold stage, without ruling on the basic idea of the loan forgiveness program that appeared to trouble the justices on the court's right side.

Roberts was among the justices who grilled the Biden administration's top Supreme Court lawyer, Elizabeth Prelogar, and suggested that the administration had exceeded its authority with the program.

Roberts pointed to the wide impact and expense of the program, three times saying it would cost “a half-trillion dollars.” The program is estimated to cost $400 billion over 30 years.

“If you're talking about this in the abstract, I think most casual observers would say if you're going to give up that much ... money. If you're going to affect the obligations of that many Americans on a subject that's of great controversy, they would think that's something for Congress to act on,” Roberts said.

Kavanaugh suggested that the administration was using an “old law” to unilaterally implement a debt relief program that Congress had rejected. He said the situation was familiar: "in the wake of Congress not authorizing the action, the executive nonetheless doing a massive new program.”

That, he said, “seems problematic.”

Kavanaugh noted that the administration was citing the national emergency created by the coronavirus pandemic as authority for the debt relief program. He argued that some of the “finest moments in the court's history" have been "pushing back against presidential assertions of emergency power.”

At another point, though, Kavanaugh suggested there might be a better fit between the program and the authority provided by Congress than there was in other cases in which the court's conservative majority ended other pandemic-related programs, including an eviction moratorium and a requirement for vaccines or frequent testing in large workplaces.

Prelogar told the justices “defaults and delinquencies will surge above pre-pandemic levels" if the program isn't allowed to take effect before a three-year, pandemic-inspired pause on loan repayments ends no later than this summer.

"The states ask this court to deny this vital relief to millions of Americans,” she said.

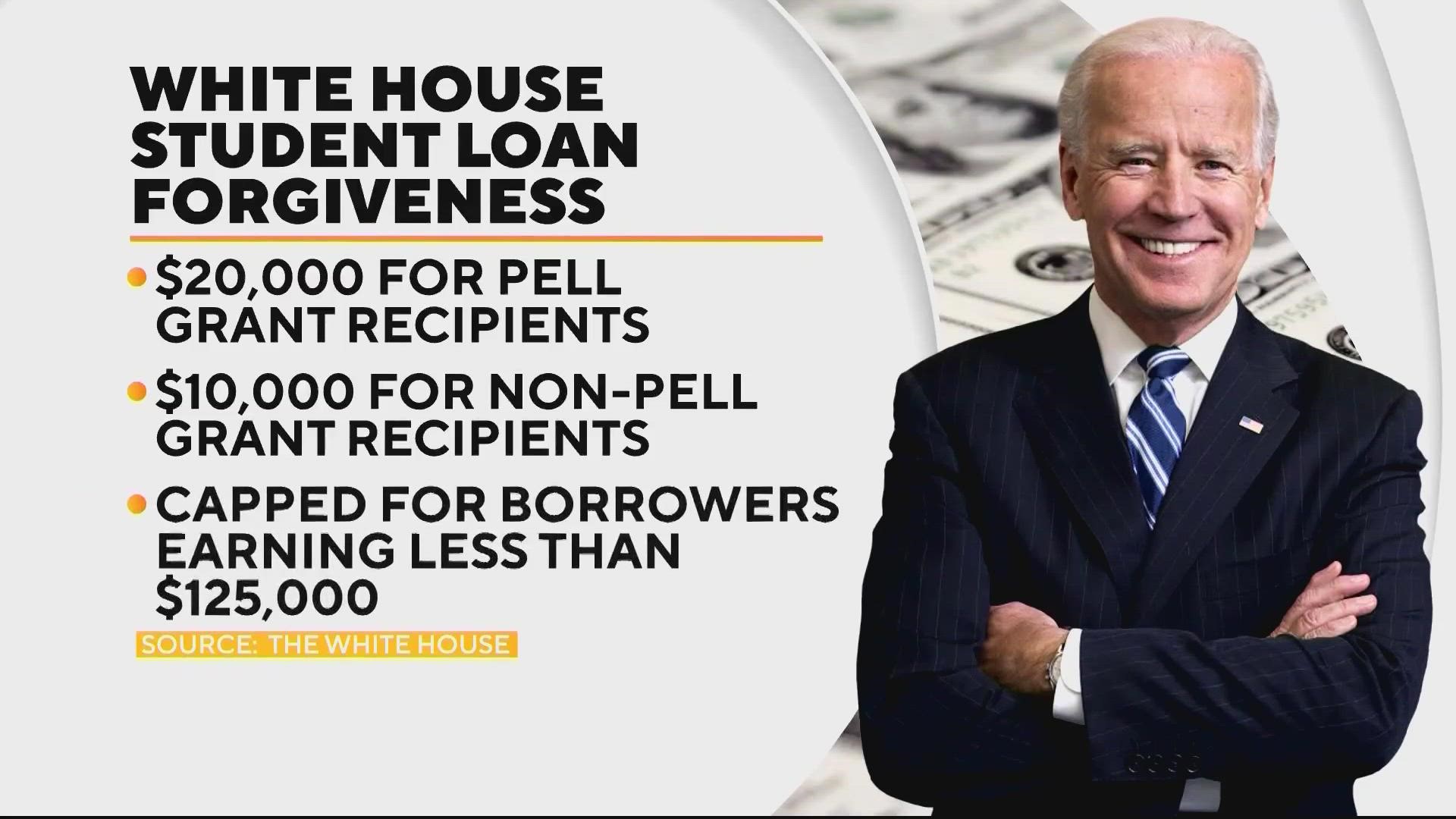

The administration says that 26 million people have applied to have up to $20,000 in federal student loans forgiven under the plan.

“I’m confident the legal authority to carry that plan is there,” Biden said Monday.

The president, who once doubted his own authority to broadly cancel student debt, first announced the program in August. Legal challenges quickly followed.

Republican-led states and lawmakers in Congress, as well as conservative legal interests, are lined up against the plan as a clear violation of Biden's executive authority. Democratic-led states and liberal interest groups are backing the administration in urging the court to allow the plan to take effect.

The administration says a 2003 law, commonly known as the HEROES Act, allows the secretary of education to waive or modify the terms of federal student loans in connection with a national emergency. The law was primarily intended to keep service members from becoming worse off financially while they fought in wars in Afghanistan and Iraq.

Nebraska and other states that sued say the plan is not necessary now to keep defaults roughly where they were before the pandemic. The 20 million borrowers who would have their entire loans erased would get a “windfall” leaving them better off than before the pandemic, the states say.

“This is the creation of a brand new program, far beyond what Congress intended,” Nebraska Solicitor General James Campbell said in court Tuesday.

Dozens of borrowers came from across the country to camp out near the court on a soggy Monday evening in hopes of getting a seat for the arguments. Among them was Sinyetta Hill, who said that Biden's plan would erase all but about $500 of the $20,000 or so she has in student loans.

“I was 18 when I signed up for college. I didn’t know it was going to be this big of a burden. No student should have to deal with this. No person should have to deal with this,” said Hill, 22, who plans to study law after she graduates from the University of Wisconsin-Milwaukee in May.

Earlier programs halted by the court were billed largely as public health measures intended to slow the spread of COVID-19.

The loan forgiveness plan, by contrast, is aimed at countering the economic effects of the pandemic.

The national emergency is expected to end May 11, but the administration says the economic consequences will persist, despite historically low unemployment and other signs of economic strength.

In addition to the debate over the authority to forgive student debt, the court is confronting whether the states and two individuals whose challenge also is before the justices have the legal right, or standing, to sue.

Parties generally have to show that they would suffer financial harm in order to have standing to sue in cases such as this. A federal judge initially found that the states would not be harmed and dismissed their lawsuit before an appellate panel said the case could proceed.

Barrett joined the three liberal justices in repeatedly questioning Campbell on that issue. But it would take at least one other conservative vote to form a majority.

Of the two individuals who sued in Texas, one has student loans that are commercially held and the other is eligible for $10,000 in debt relief, not the $20,000 maximum. They would get nothing if they win their case.

The arguments could be listened to live on the AP youtube channel or on the court’s website.

A decision is expected by late June.

___

Associated Press writer Collin Binkley contributed to this report.