WASHINGTON, D.C., USA — No one likes to hear the dreaded R word "recession." We all want to live in a flourishing economy, but what goes up must come down. When the financial world takes a turn for the worse, that doesn't mean you have to put all your dreams on hold. If your personal status hasn't changed, an economic slowdown is still a good time to buy a home. Here's how you can come out on top from The Yi Team of Fairway Independent Mortgage Corporation.

Take advantage of lower interest rates. When the economy is in a slump, the Federal Reserve lowers interest rates to stimulate growth. Lower financing costs encourage borrowing and investing. These decreased rates are ideal for prospective home buyers. It's also a great time to look into refinancing your mortgage.

Less competition drives down housing prices. People often think of when's the best time to buy a new home in terms of seasons. But whether it's spring or fall isn't the determining factor to consider in the real estate market. The economic state is key. When the economy is slower, fewer people are able to throw their hat in the ring. Less competition keeps housing costs lower. This is the perfect time to put in an offer that's less likely to get out-bid.

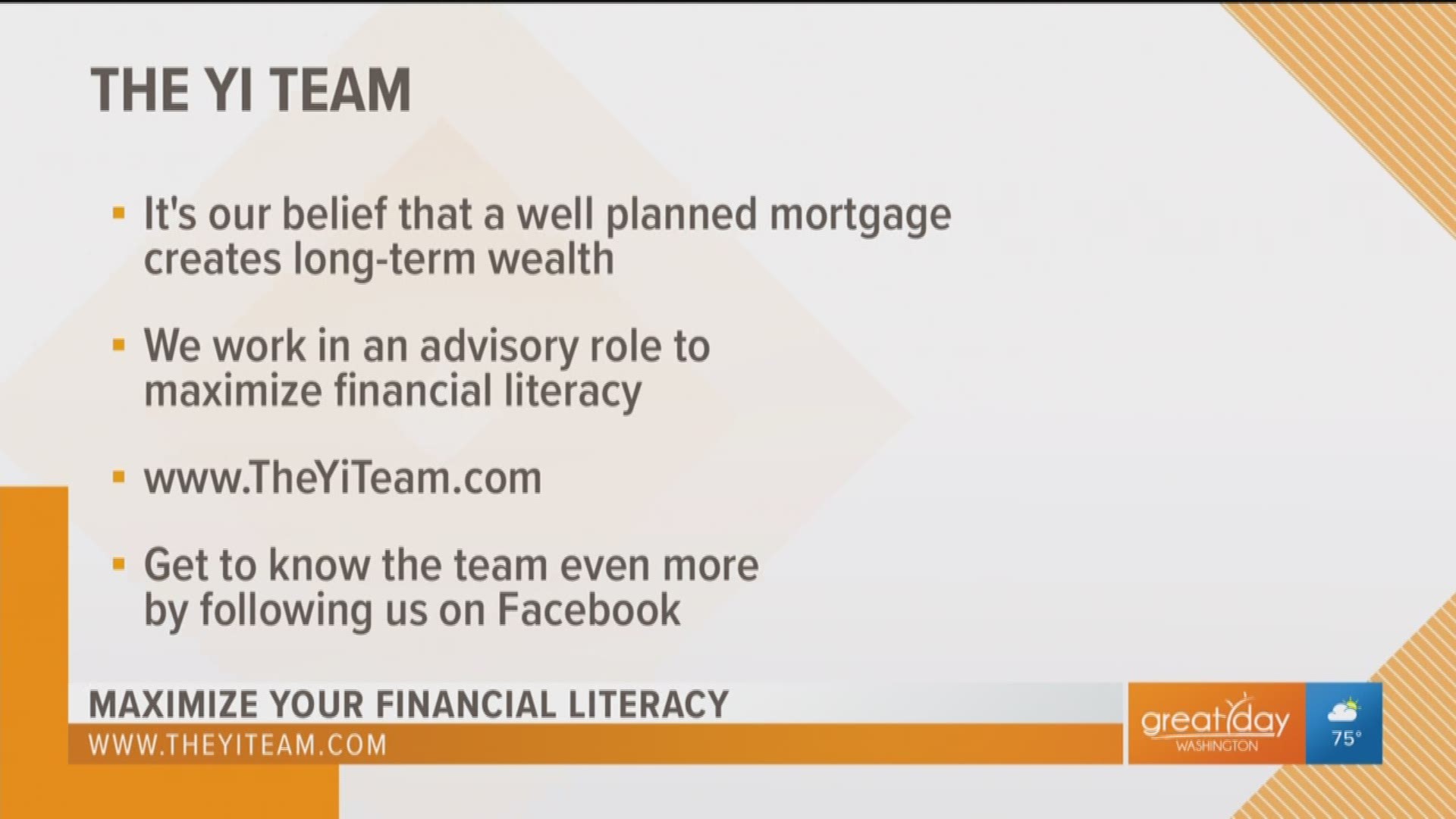

Seek out a Mortgage Adviser, not a Loan Officer. In any economic situation, it's important to have a professional who knows your finances and will advise you accordingly. You may think getting the biggest loan possible is the way to go, but a monthly payment that's too high will cause financial strain. A reasonable loan will insure you stay above water. Think of mortgage as an investment, not added debt.

This article is sponsored by The Yi Team of Fairway Independent Mortgage Corp. Additional information provided by Investopedia.