QUESTION:

Can you get a tax deduction for using the I-66 tollway?

ANSWER:

Yes--but it's a layered answer.

SOURCES:

Lisa Greene-Lewis- CPA and tax expert at Turbotax

at HR Block

"First Week Update:66 Express Lanes Inside the Beltway"- Virginia Department of Transportation

PROCESS:

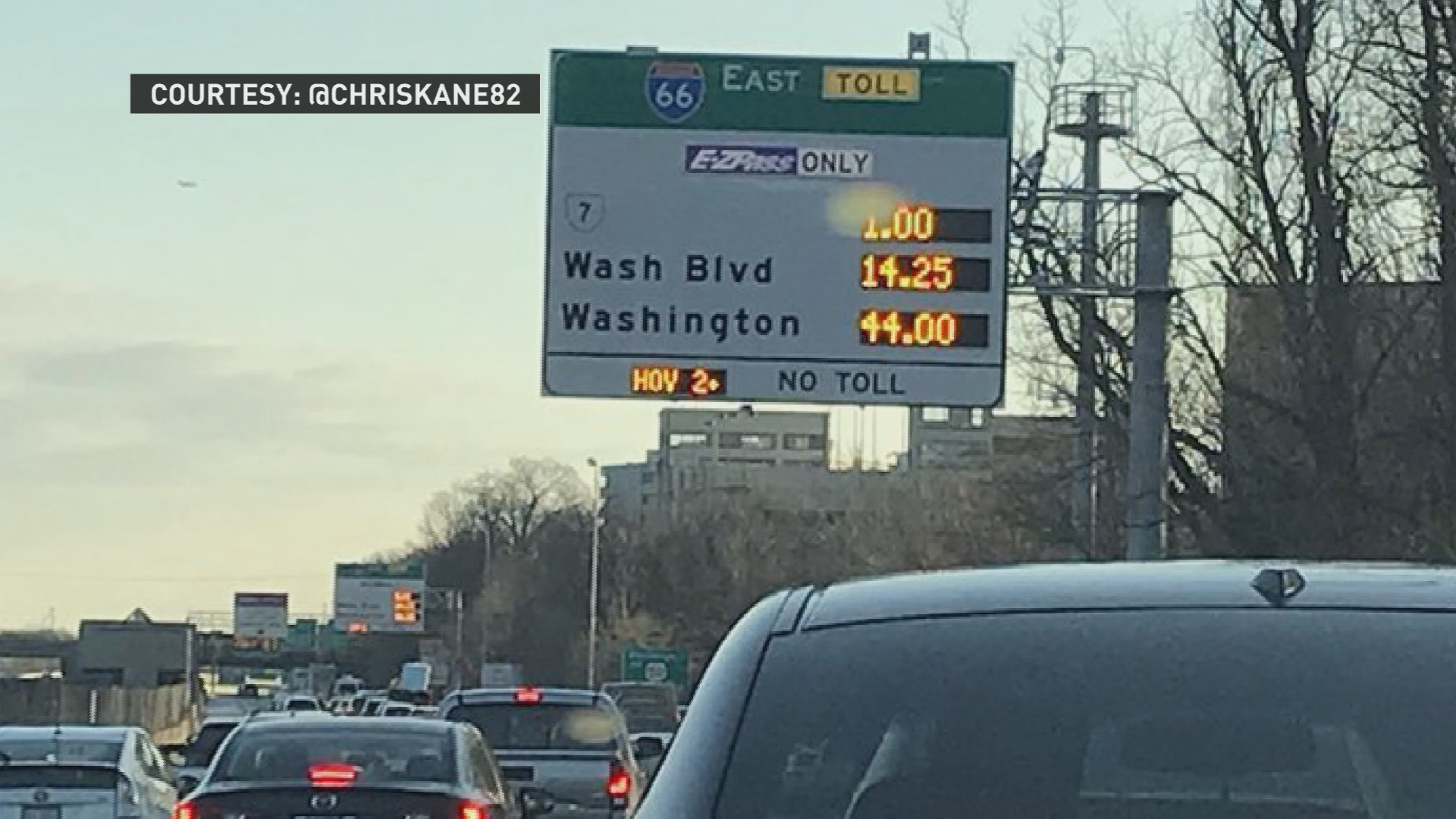

Tolls on the I-66 Beltway averaged $8-$13 eastbound and $3-$5 westbound the first week of operation, but locals have seen the fare skyrocket as high as $44 dollars.

Is there any silver lining for the DMV workforce?

Business owners can file tolls as a business expense along with gas and parking fees if they have a fleet of employees they reimburse.

It's the same deal for anyone who's self-employed or employees that don't get reimbursed.You can't write off tolls if your employer already reimburses your driving expenses.

There is one catch--you can only get a tax break when using the tolls for business travel, not for using toll roads on your daily commute to work, says Lisa Greene-Lewis, CPA for Turbotax.

The GOP Tax Bill emerged from conference committee on Friday, December 15. According to Greene-Lewis the only thing that changes for toll deductions is that employees who do not get reimbursed for tolls by their employee will be out of luck.

Tax Reform scraps some of the miscellaneous deductions including tolls.

"If you're a business owner, self-employed, it will be business as usual for you in 2018, you'll still be able to deduct your tolls or parking, if you're an individual and have an employer and you have these unreimbursed expenses those are being eliminated," Greene-Lewis says.